UnionDigital Bank, the digital bank subsidiary of UnionBank, has recently partnered with HUAWEI, a global technology leader, to bring innovative financial services to more people in the Philippines by tapping into the tech company’s ecosystem of services and 7 million customer base.

Through the strategic collaboration, the UnionDigital Bank app is now available on the HUAWEI AppGallery to allow easy access for users to the digital bank’s financial services and products. As the number one digital lender in the country, UnionDigital Bank will offer loan products to mobile users through Petal Ads, the mobile marketing platform tailored for HUAWEI devices.

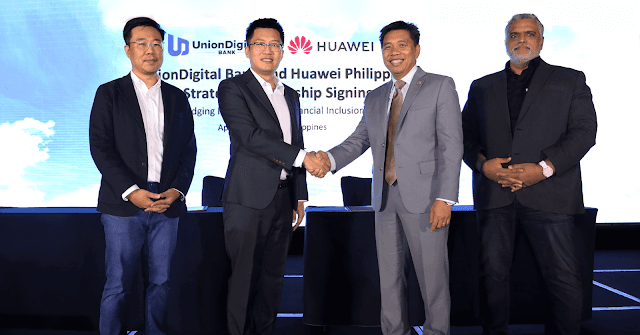

"Our partnership with HUAWEI reflects our shared belief in harnessing the power of technology to enhance financial inclusion and provide convenient banking solutions to all," said Henry Aguda, President and CEO of UnionDigital Bank. "Together, we are committed to shaping a better future by leveraging our combined expertise and resources to create innovative and accessible banking services."

"We are proud to work with a tech-first and tech-forward company like UnionDigital Bank, who shares our vision for leveraging technology to create positive change and make a difference in people's lives," said Ken Liang, Director of Mobile Ecosystem Business Growth, HUAWEI Technologies Philippines. "Our alliance reflects our commitment to driving innovation and using it for the greater good. We are excited to collaborate with UnionBank’s digital bank subsidiary to contribute and help in making their commitment a reality, starting with our users."

The tie-up between UnionDigital Bank and HUAWEI marks an important step towards promoting financial inclusion and leveraging technology to make innovative banking solutions closer to a greater number of Filipinos, regardless of their location or economic status. Together, they aim to empower more people to access essential financial services designed to contribute in supporting the country’s growing digital economy.

Post a Comment

0Comments